Powerful, Secure Data Room Software That Can Be Set Up in 10 Minutes

Meet the virtual data room software designed to be instantly usable so you can start managing your confidential documents for M&A due diligence, fundraising, partnerships, IPOs, and other transactions.

Data Room Software Reimagined

With an easy-to-use interface, 24/7 dedicated support team, sophisticated security features, and transparent, flat-fee pricing, SecureDocs offers a different experience with virtual data room software. Rapid self-setup means you can have your virtual data room up and running in 10 minutes or less - no need to speak with a salesperson or commit to any technical training. The intuitive, quick-start design means you’ll be deal-ready in minutes.

Try It Free

Explore SecureDocs Data Room Software Features

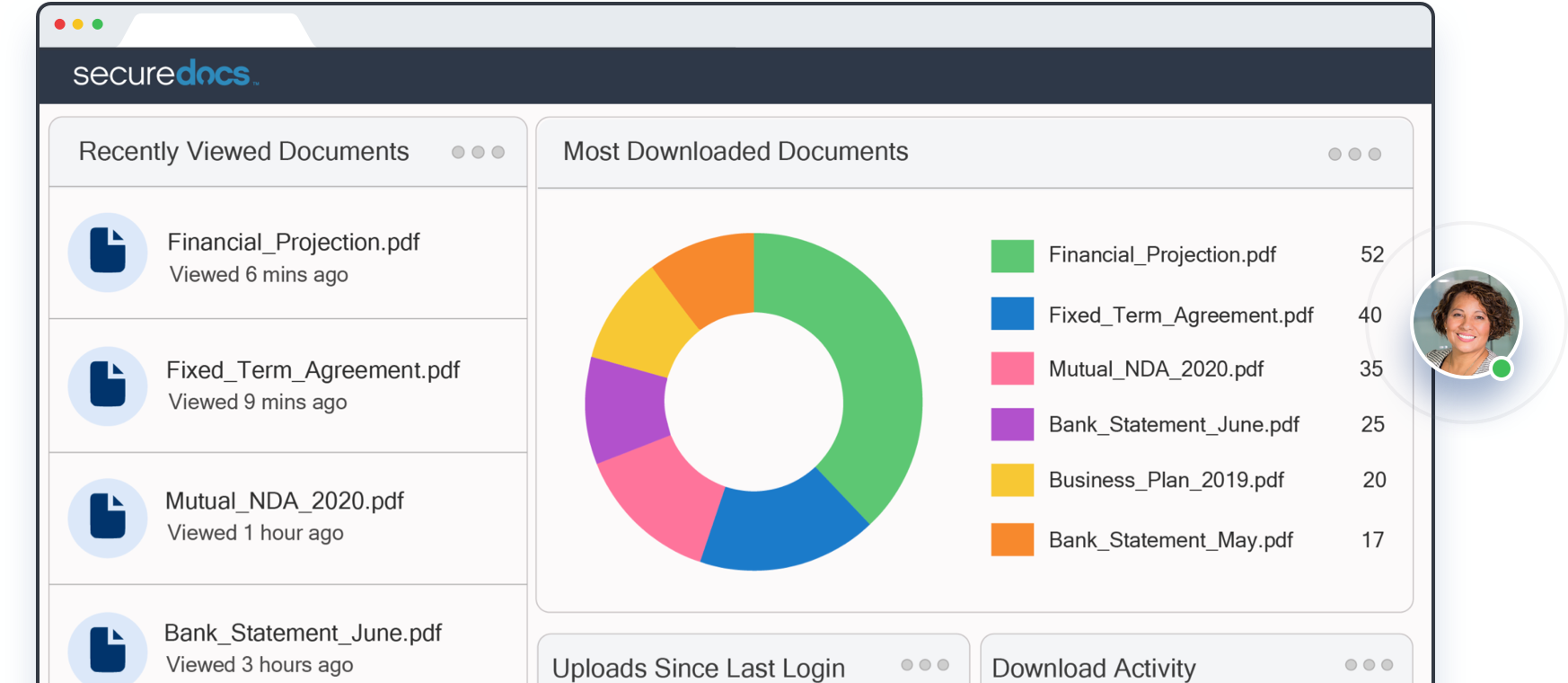

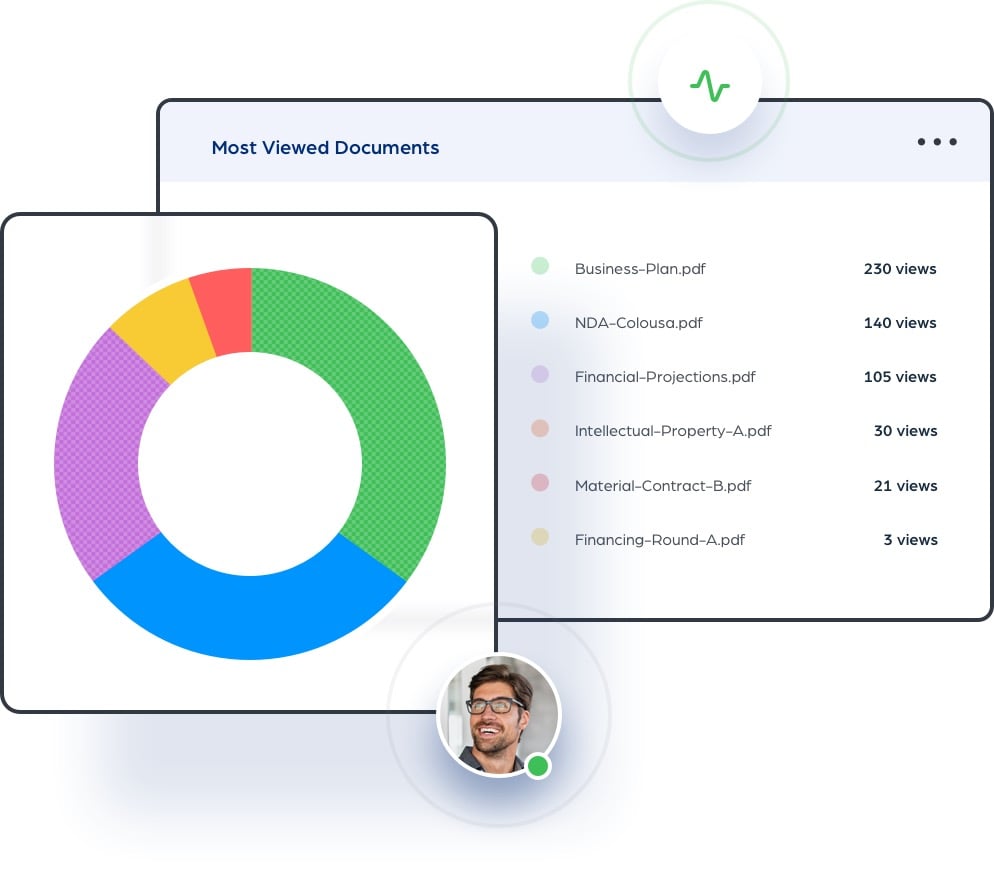

Make smart assumptions. Customizable dashboards and real-time user statistics allow you to analyze the activity of individuals or groups to gauge buyer or investor interest.

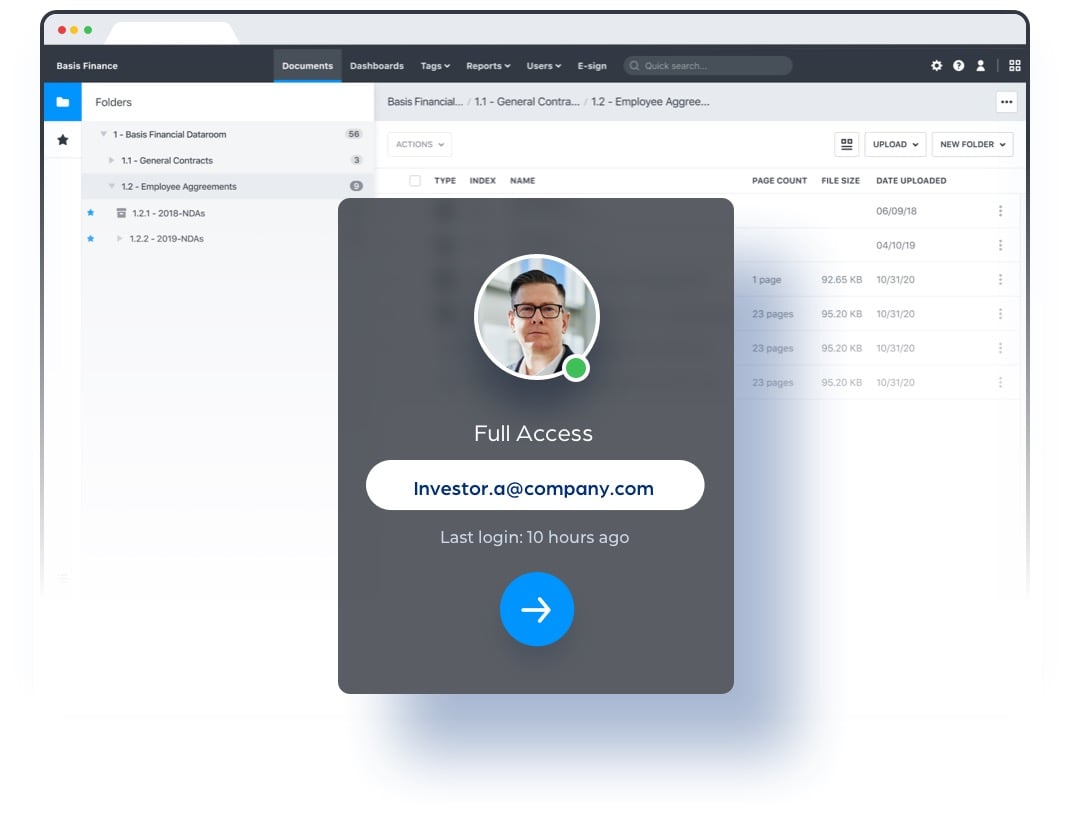

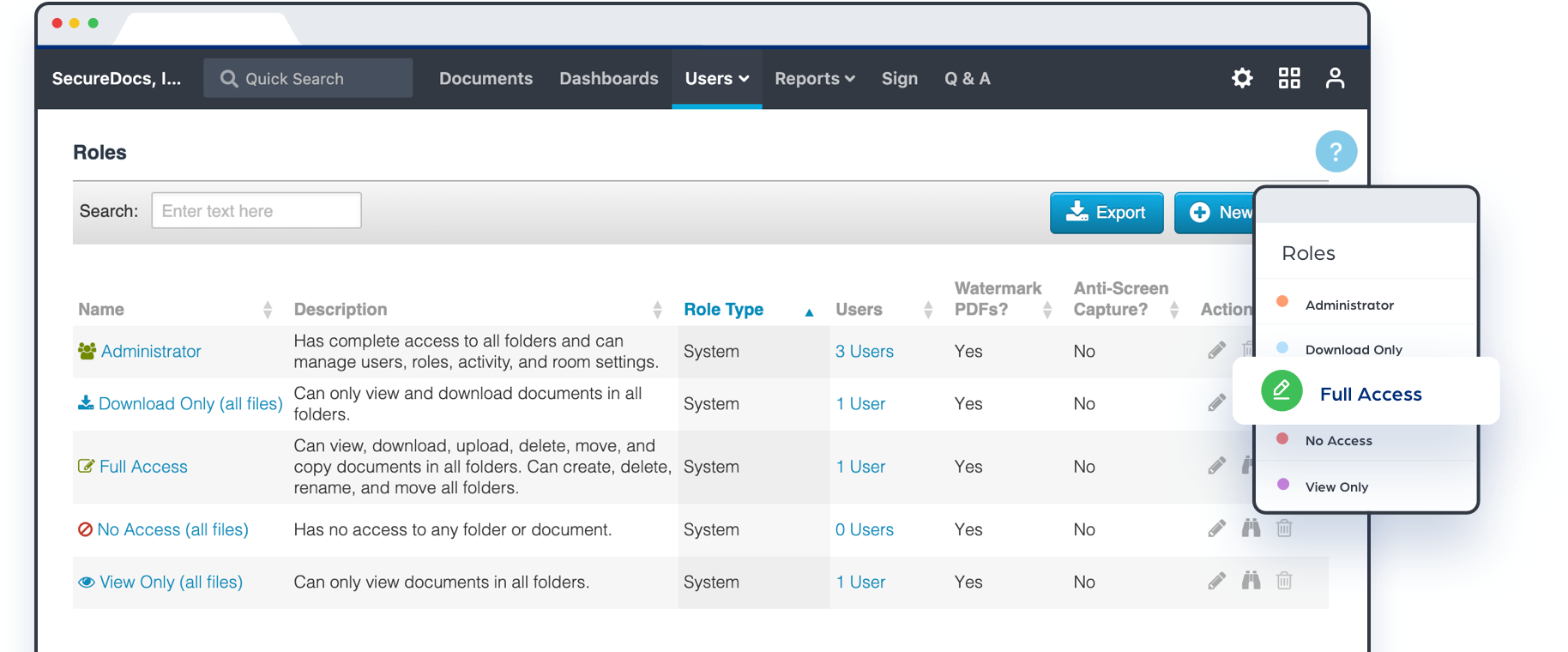

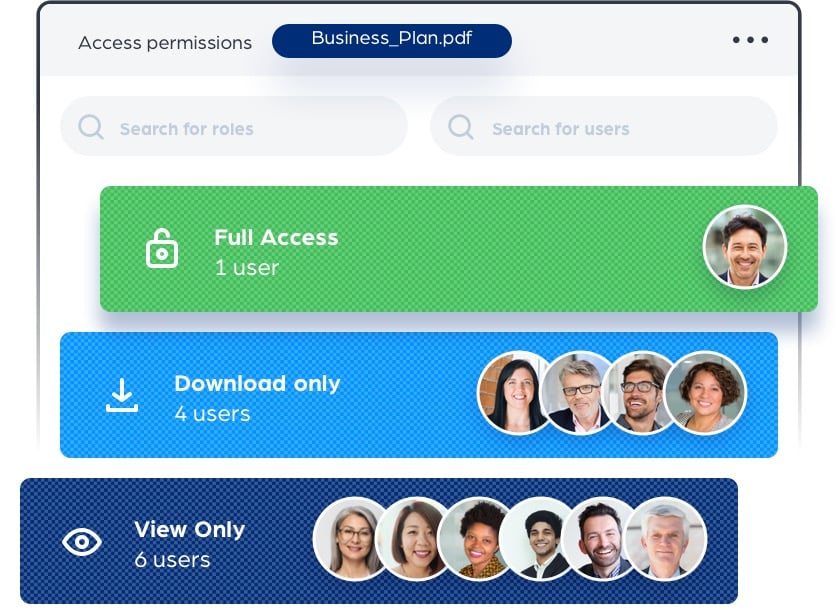

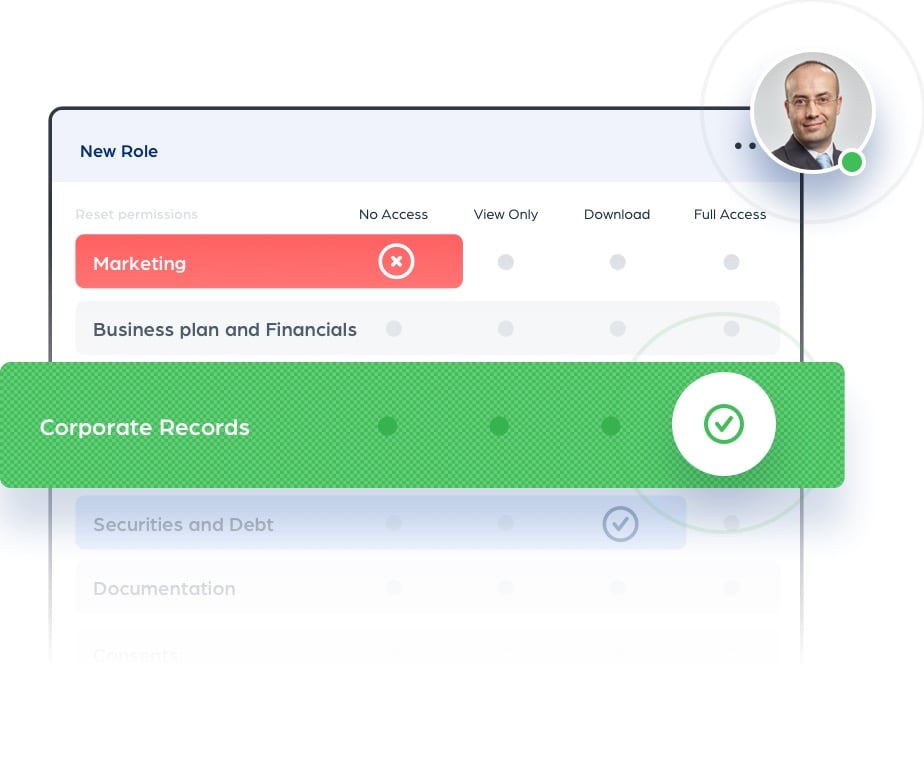

Control access to confidential company information with permission-based user roles to define full access, no access, view only, or download.

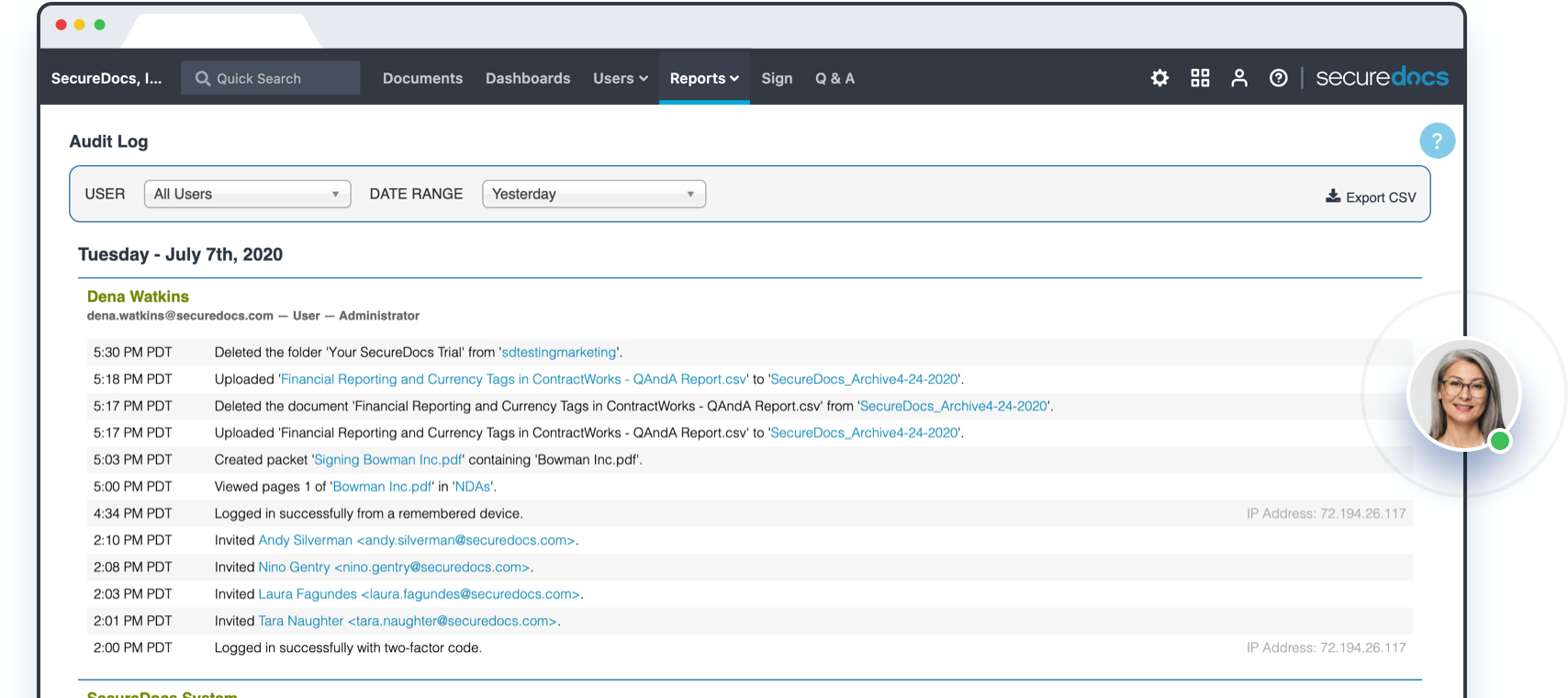

Detailed audit logs keep administrators informed of all data room activity. Includes date and time stamps and optional daily reporting.

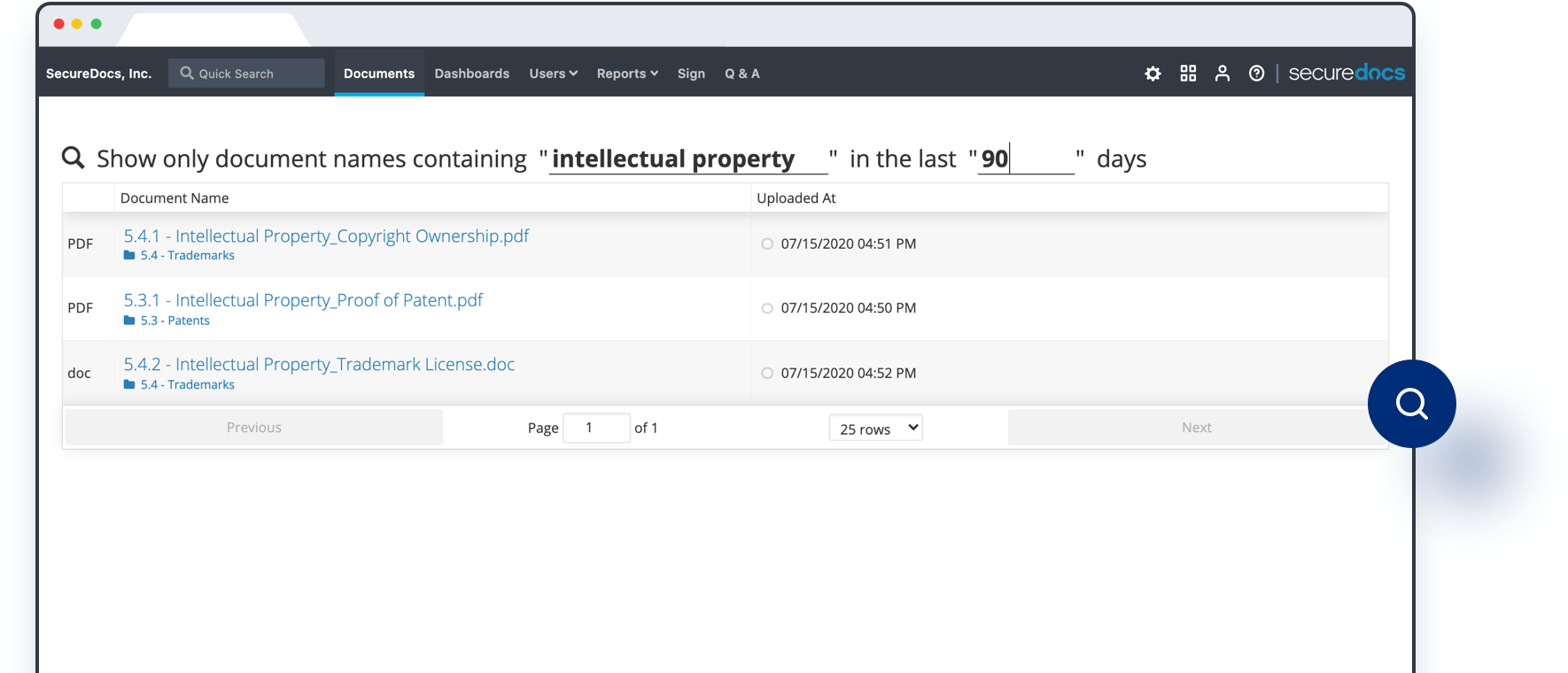

Find any document in your virtual data room fast with our advanced search feature.

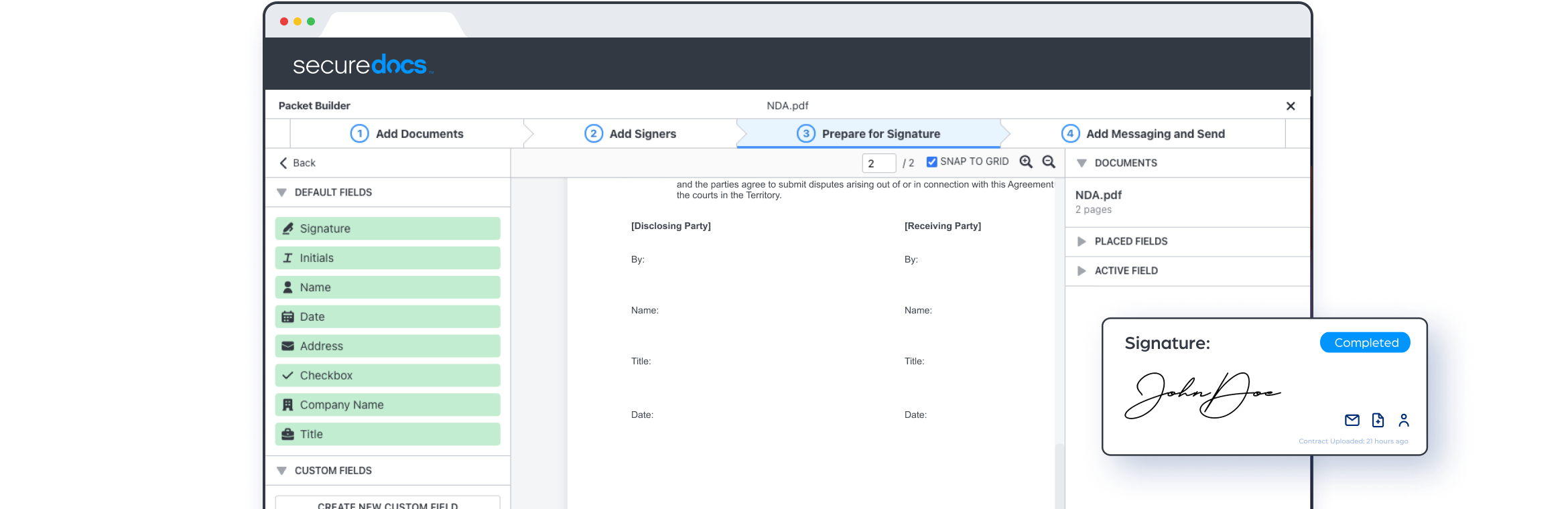

Quickly create, send, and sign NDAs, confidential information memorandums, and other deal paperwork using SecureDocs e-signature and templates

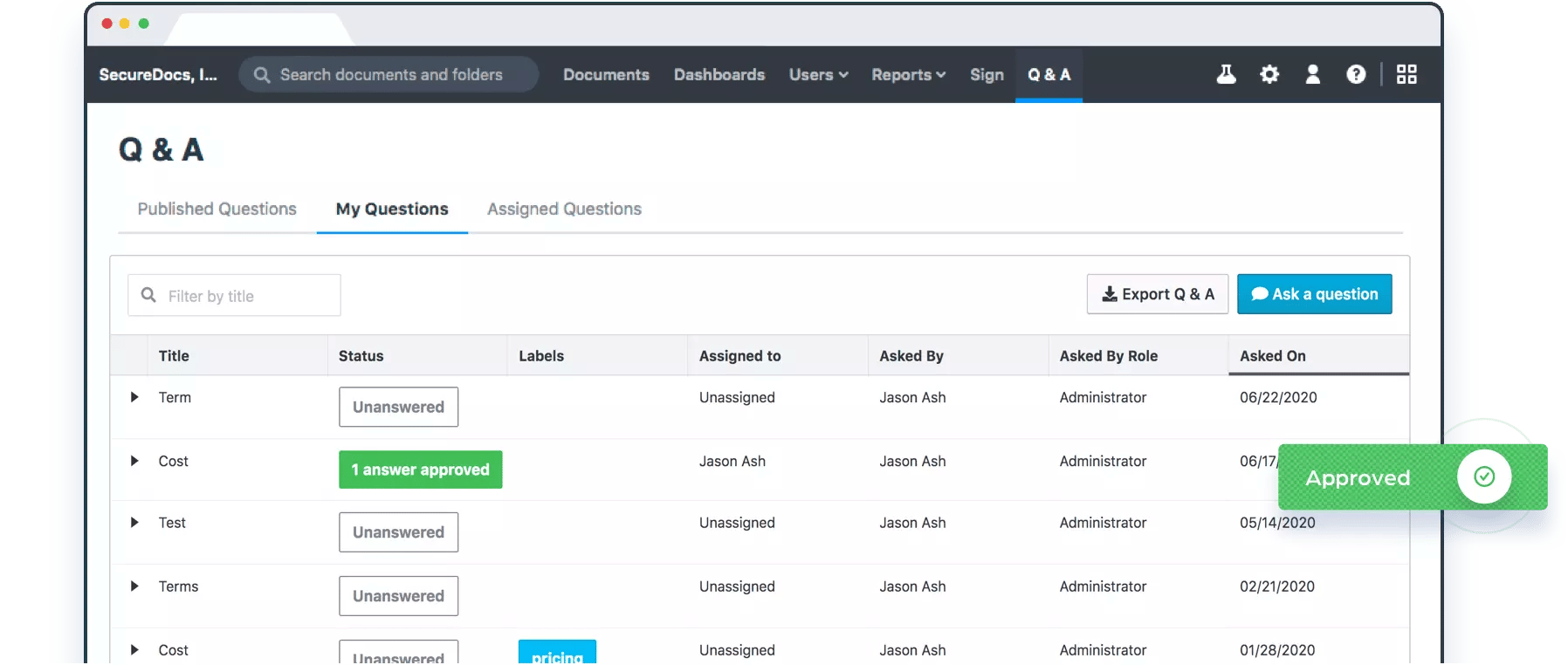

Answer questions directly in your virtual data room or via email. Publish FAQs to your data room and save time.

Instant Usability with

Quick-Start Setup

Simple, intuitive design complements robust, industry-leading security for a different approach to data room software. Your virtual data room is easy to launch and conveniently deal-ready in minutes, no time-consuming training required. Start managing your confidential corporate documents immediately.

Try it Free

Stay in Control of Sensitive Information

Control your company’s most critical documentation with SecureDocs advanced security features. Granular user permissions, watermarking, customizable NDAs, and an exportable activity log, make it easy to manage sensitive information confidently.

Try it Free

Gain Valuable Insight into

Your Data Room Activity

Understanding what’s happening in your virtual data room provides valuable insight to gauge interest from buyers, investors, or other external parties. Your SecureDocs customizable dashboard lets you filter activity by user, role, or group, document uploads/downloads, and document views.

Try it Free

Better Virtual Data Room Software

SecureDocs data room software makes managing and sharing highly-sensitive documentation easy. With an intuitive interface and powerful security features, you’ll be confidently using your data room in minutes.

24/7 Service and Support

Built-In Electronic Signature

Unlimited Storage and Unlimited Users

SAML 2.0/ Single Sign-On (SSO)

Industry-Leading Security Features

Amazon Web Services Data Centers

Affordable Pricing Options to Fit Your Needs

Choose the affordable, flat-fee pricing that’s right for your business. With no hidden fees, you’ll always know what to expect.

3 Month Plan

$400 /Month Billed QuarterlyChoose this plan when you need a secure data room for a short-term project. Ideal for safely executing, sharing, tracking, and storing documentation related to divestments, M&A, and bankruptcy.

12 Month Plan

$250 /Month Billed AnnuallyChoose this plan when you have a long term project or want to build a corporate repository to stay prepared for deal-making opportunities as they arise. Also perfect when you anticipate a deal taking longer than 3 months to complete.

Volume Packages

Options availableChoose this plan if you’re managing multiple deals simultaneously and need a secure virtual solution to keep everything organized and moving forward. Billed annually. Contact us for volume pricing.

“SecureDocs combines a lot of features into one. We like the esignature, we like the ability to customize user roles and permissions, we like having an archive of our critical documents. And when we compared it to the other data rooms, SecureDocs stood out in functionality and ease of use.”

“The data room is not meant to be a complicated part of the deal. It should be really straightforward, easy to use, and no one should have any access issues. With SecureDocs the data room is not a problem.”

“SecureDocs allowed us to quickly, reliably disseminate due diligence to buyers, and that helped us save over 100 hours on our overall deal timeline.”