The Official SecureDocs Blog

Stay on top of the latest tips, trends, and best practices for M&A, fundraising, and other business events.

Browse by topic

Subscribe to our blog

-

Venture Capital

Private Equity 2023 Mid-Year Recap: A Tough First Half

-

Venture Capital

The Free Fundraising Template for Entrepreneurs

-

.jpg)

Venture Capital

How to Pitch to Investors in a Remote Environment

-

.jpg)

Venture Capital

Alternative Venture Capital vs. Traditional Venture Capital

-

.jpg)

Venture Capital

6 Ways to Fund Your Business in 2020

-

Venture Capital

The Story Behind the World's Largest Directory for Women in VC

-

Venture Capital

Is the Venture Capital Bubble About to Burst

-

Venture Capital

Top 5 Questions a VC Should Ask a Startup CEO

-

Venture Capital

Can Biotech Sustain the Venture Capital Investment Surge?

-

Risk & Compliance

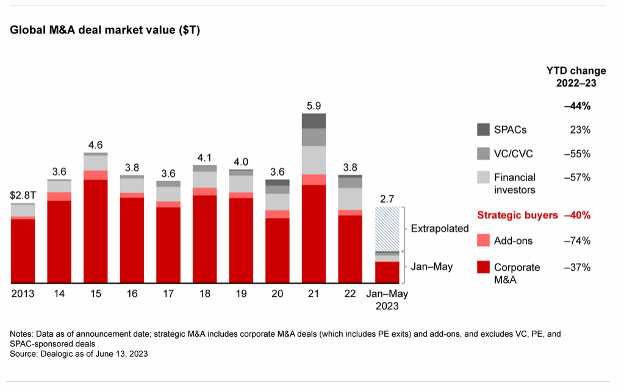

M&A Activity is Soaring High, But What Does It Mean?

-

Venture Capital

New Ways to Raise Money in 2018

-

Risk & Compliance

6 Reasons M&A Deals Fail

current_page_num+2: 3 -