Virtual Data Rooms:

Everything You Need to Know

Learn why SecureDocs Virtual Data Rooms are the solution of choice for business transactions.

Learn why SecureDocs Virtual Data Rooms are the solution of choice for business transactions.

With immediate account activation - no waiting for sales or technical training - and a streamlined interface, you can drag and drop deal documents into the system and get set up in minutes.

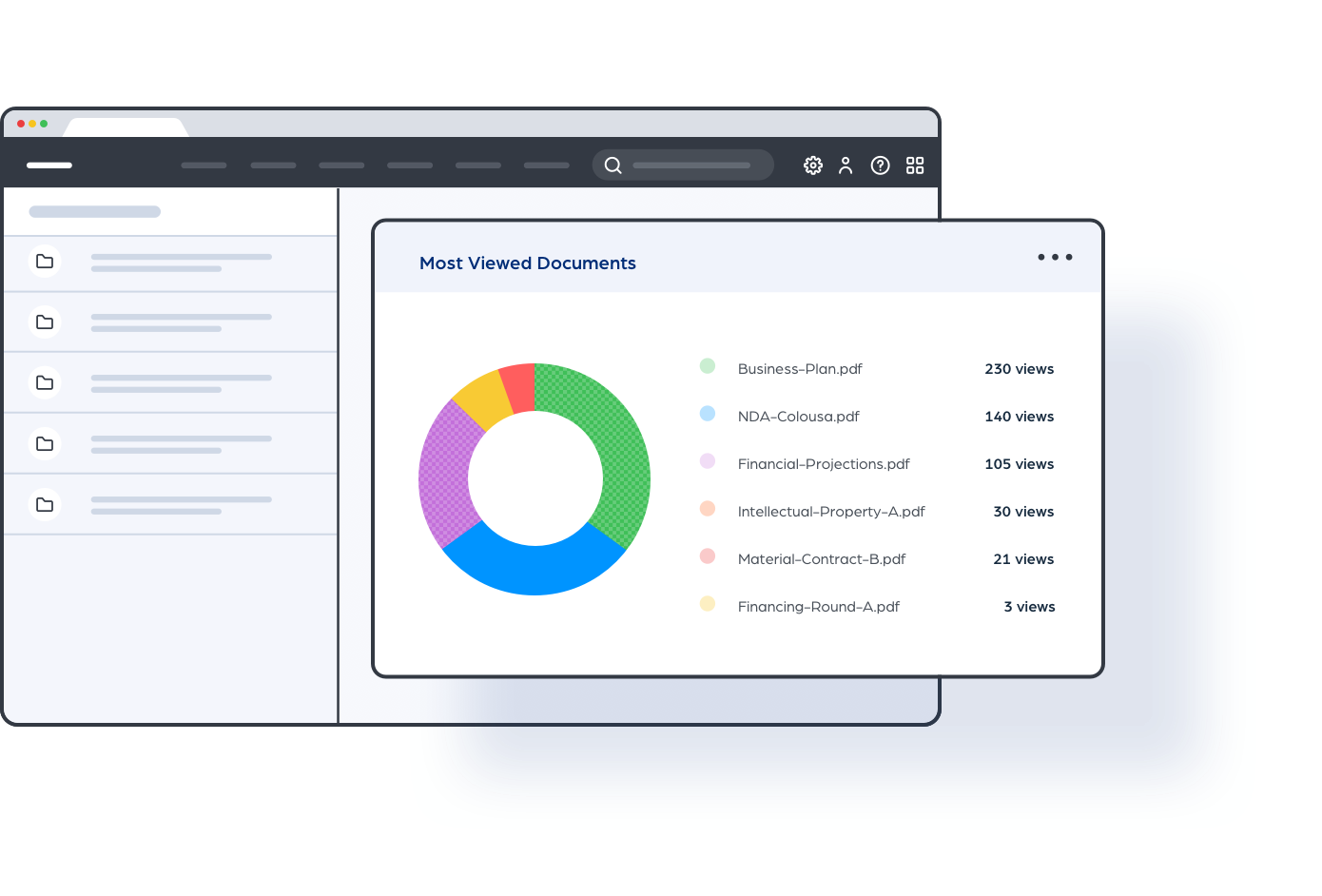

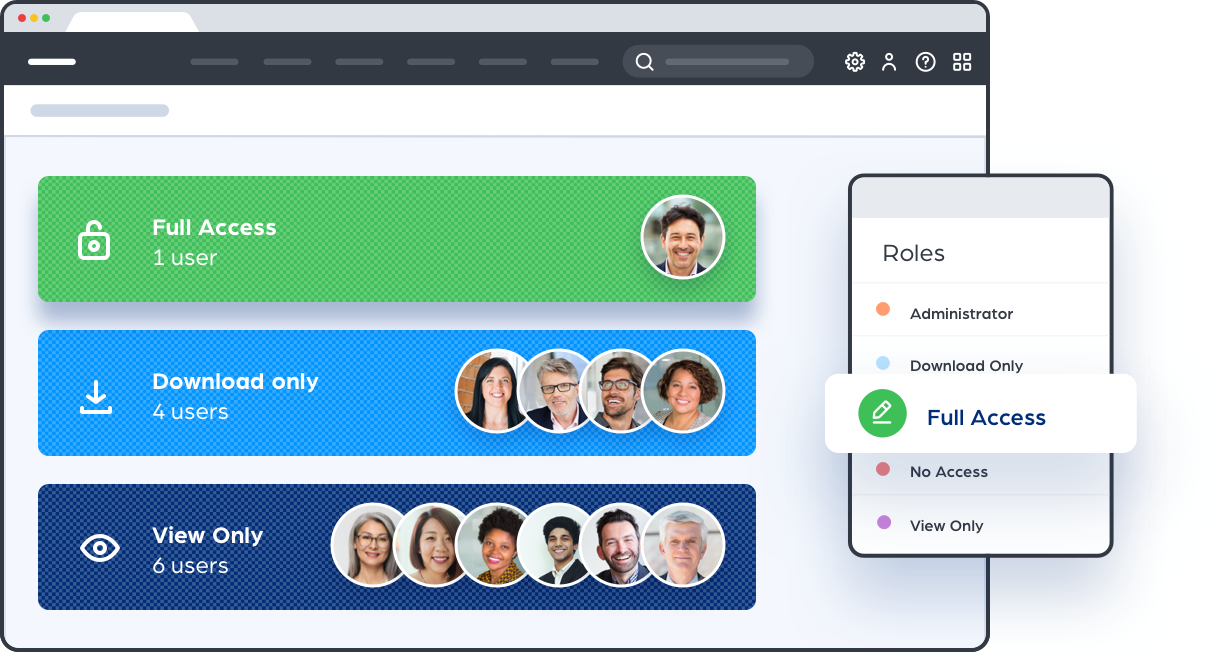

Avoid deal delays by quickly granting buyers, investors, and external partners access using custom permission settings. Rely on powerful features like Q&A, custom dashboards, and the audit log to ensure you keep control of your documentation and the transaction with valuable insight into your data room activity.

Customers recommend SecureDocs because it is easy to use and provides all the features and support needed to conduct secure transactions without hassle or worry.

With affordable, flat-rate pricing starting at $250/month for unlimited users and data, there's no time wasted with cost negotiations and no questions about finding a return on investment. SecureDocs delivers everything you need to ensure your transactions remain on track and secure.

Instant account activation and drag-and-drop uploads allow your SecureDocs data room to get up and running in 10 minutes or less.

Leverage data room insights to maximize deal value. Respond to questions directly from your virtual data room with the Q&A function.

You decide who sees what. With permission-based user roles, two-factor authentication, watermarking, and customizable NDAs, you can run your deal with confidence.

Search smarter using advanced search features. Providing the information you need at your fingertips precisely when you need it.

Experience the only virtual data room with a built-in electronic signature. Quickly and securely create, send, and sign deal paperwork using SecureDocs e-signature and templates.

Start your free trial of SecureDocs today. Your data room will be available immediately - no need to talk to a salesperson.

Chapter 1

As the name suggests, a virtual data room, or a “VDR,” is an online database in which companies can store and share confidential information, usually used during a financial transaction. VDRs are also used as ongoing document repositories, allowing businesses to organize critical business documents for easy, secure access.

VDRs are used by companies to securely store and share critical and sensitive corporate data and are most commonly used during deals. The information stored in a data room is generally private documentation that is considered to be of high value to the company or owner of the data room. Of course, in addition to traditional record keeping that is required for many financial, legal, and tax matters, a lot of companies have other important documents and information they need to retain and would like to store safely to ensure that it remains confidential. For example, items relating to intellectual property, such as trade secrets and copyrighted works, must be convenient to access but also stored in a highly secure location. Because of the growing importance of data and the ensuing increased demand to ensure that such data is adequately safeguarded, the virtual data room was born, and over the years, it has evolved into an important business solution used by organizations around the world.

Chapter 2

Virtual data rooms give businesses a way to easily organize, store, and share sensitive documents, and are far more affordable than traditional physical data rooms that were once the norm. With virtual data rooms, M&A transactions can be carried out much more effectively and efficiently from almost any location.

For financial transactions, virtual data room software has become standard practice, replacing the once-ubiquitous physical data room. Physical data rooms had their limitations and were time consuming and inconvenient for the parties involved. With the advancement of online security (which is of paramount importance to virtual data rooms), the physical data room became an outdated concept, and was eventually replaced by virtual deal rooms, where companies could share due diligence information securely, no matter where they’re located.

Chapter 3

Virtual data rooms are most commonly used to help facilitate financial transactions, including mergers and acquisitions, fundraising, and IPOs, but there are many other reasons businesses use VDRs to manage sensitive documents. Here are the 8 most common uses of VDRs.

M&A due diligence is a common use case for a VDR. Merging with or acquiring other businesses involves a lot of research, particularly the furnishing and reviewing of volumes and volumes of documents. For companies merely entertaining a purchase offer, it can be daunting to hand over the sensitive data that will be requested. Thus, companies heavily engaged in M&A can still participate in negotiations and allow for the safe viewing of valuable, confidential data by relying on a purpose-built VDR. And, in the event that a deal does not close, access to the data room can simply be revoked.

For both startups and larger enterprises, engaging in various fundraising rounds is one of the keys to growing a business. And, as many entrepreneurs know, convincing investors to fund a business is not exactly an easy feat. In general, fundraising mandates a great deal of data and document sharing, especially during the due diligence investigation. During these fundraising phases, using a VDR can help facilitate the requisite exchange of sensitive information, and leadership teams on both sides of the deal should feel comfortable given that using a VDR will allow for better control and oversight.

IPOs can be particularly onerous transactions, as the decision to go public means that companies will be subjecting themselves to additional rules and regulations, often at the local, state, and federal levels. In addition, this transition requires more transparency for the public and prospective shareholders. In order to go through all of the necessary steps to launch and survive an IPO, meticulous document retention and management will be key, which can be easily accomplished using a VDR.

Even if companies do not formally merge or acquire another business, it often makes sense to partner with other firms for the provision of some good or service or to engage in an entirely new venture. As with most partnerships, these sorts of arrangements will undoubtedly require a substantial amount of data sharing. This is once again a situation in which using a VDR will prove invaluable, and will ease the minds of the leaders involved in the partnership, as they can rest assured that all valuable data will be protected.

There are plenty of situations in which external parties will need to review a company’s data, although not necessarily in an adversarial or competitive nature. For example, when legal counsel, accountants, or auditors need to take a look at a company’s corporate records or other documentation, the leadership team will have to find a way to provide them with the information they need without allowing it to be compromised. This is another example of how a VDR can be used to facilitate virtually every document sharing need a company may have.

In some cases, companies may not be as concerned about sharing sensitive data with external parties, but still need a coherent data security strategy. This is particularly true for startups and other businesses whose growth and survival is highly dependent on safeguarding intellectual property (IP). For companies falling under this umbrella, establishing a VDR to store any and all IP-related documentation is an extremely wise decision, especially when maximum security standards are a must. Company leaders and their legal counsel will be pleased to know their invaluable IP will continue to be invaluable.

Sometimes, board members insist on being heavily involved with a company’s leadership team and other facets of the operations. But, board members do not always reside nearby or make frequent visits to the office headquarters. In these instances, when key personnel are scattered across the country, or even across the globe, it will be critical to have a system in place that allows for the instant yet secure sharing of information. One of the best ways to ensure that documents are shared quickly and safely is by storing them in a VDR and then granting access to others, including remote board members, as appropriate.

Ultimately, in any scenario in which a company needs to securely share documents with service providers, prospective investors, any other external parties, or even amongst its own internal employees, having a reliable VDR with stringent security measures already in place will make this process much quicker and easier. Perhaps best of all, those involved do not have to be as worried about information being stolen or misappropriated.

The bottom line is that a VDR can come in handy for C-level executives needing to share confidential files and data amongst themselves, HR departments responsible for maintaining employee records, project managers in charge of various aspects of business operations, and countless other scenarios.

A simple, user-friendly VDR with the features you need to get deals completed.

Try it Free

Chapter 4

Virtual data rooms are used by any company looking to securely store and share important documents, but there are a few industries who make up the heaviest users. Life science and technology companies use VDRs to protect proprietary data, but businesses in every industry have reasons to invest in VDRs.

It’s clear by now that businesses across every industry have been turning to virtual data room providers, instead of physical data rooms, for years, and for good reason. The evolution of the data room industry has changed the way people do business, and VDRs now serve as a necessary tool for all parties involved in any business deal. They provide users 24/7 access to business information in a secure online location that can be accessed from almost anywhere, all while minimizing the risk of human error that could potentially kill a deal. But, as previously addressed, a deal room goes beyond a diligence round during M&A. Virtual data room providers help many industries successfully complete all corporate events in a secure, controlled, and malleable way.

Here are a few industries that commonly use VDRs:

Technology is an industry fueled by rapid innovation and growth. Companies are constantly raising funds, getting acquired, going public, and more. Having a secure, controlled way for corporate document sharing and storage is of paramount importance for tech. A data room for technology companies commonly facilitates the following financial transactions and business needs:

Raising venture capital

M&A

Corporate document storage

Audits & compliance

IPO

HR files

The life sciences industry, commonly comprised of biotech, medical devices, and pharma companies, has a lot of intellectual property to protect. Companies in the life sciences industry frequently partner with other companies, license IP, raise funds, and have the need to protect an intellectual property portfolio. A data room for life science companies commonly facilitates the following:

Fundraising

Clinical trials

Licensing IP

HIPAA regulations compliance

Strategic partnerships

M&A

Investment bankers look for a reliable virtual data room solution that streamlines the deal process. The world of M&A is complex, so simple, secure, and efficient due diligence is critical. Investment bankers are frequent users of online deal rooms and typically use them for:

Buy-side M&A

Sell-side M&A

Capital Raising

Rights issues

Strategic partnerships

IPO

Legal firms need to securely share confidential information with clients, staff, and other parties of interest. Virtual data rooms provide a streamlined solution that allows them to do this simply and quickly, as time is key. Legal firms use online data rooms for:

M&A

Fundraising

Strategic partnerships

Litigation

Bankruptcy

Private equity and venture capital firms conduct many types of business transactions, all which require sharing data with numerous parties. These companies are dealing with many complex financial transactions and must do so securely and quickly. Private equity and venture capital use data rooms for:

Equity investments

Buy outs

Exits

Raising a fund

Partner communication

Investor communication

Chapter 5

Virtual data rooms come in all shapes and sizes, and can vary greatly in terms of pricing, ease of use, customer support, and more. Before choosing a provider, it’s important to evaluate your options and find a solution that enables you to move through the deal process efficiently.

Regardless of industry, it’s important that companies seek out the type of VDR provider that best suits their unique needs. It's common for companies to look for providers with specific feature sets, price points, security implementations, and usability, which can be tested during a free trial - offered by most providers in the industry. Below are three main types of solutions that companies tend to vet when looking for a VDR, including traditional virtual data room providers, modern virtual data room providers, and collaboration tools. Here is a breakdown of these various solutions, including a comparison of virtual data room pricing, security, usability, and features.

Datasite

RR Donnelley

Intralinks

In general, the traditional data room category is comprised of three data room providers: Datasite, RR Donnelley, and Intralinks. These companies have a long history in the M&A space, and are known for being feature-heavy and secure, specifically for M&A. Many of them allow for significant data uploads and storage, but these data rooms are also fairly expensive. It is important to highlight that many of the traditional data rooms were initially designed with the M&A process in mind, as the due diligence process for M&A has always mandated voluminous data sharing and document scrutiny. But, because this significantly influenced their creation, pricing models tend to reflect this history - per page upload fees, fees for extra users, etc., making this the most expensive category of data room. Traditional VDRs can also be cumbersome to use, based on the complex set of features.

SecureDocs Virtual Data Room

OneHub

Ansarada

In the last 10 to 15 years, a number of modern virtual data rooms have emerged. Three solutions that stand out in this category are SecureDocs, OneHub, and Ansarada. In contrast to the traditional solutions, modern VDRs tend to be easy to use, quick to set up, and relatively inexpensive to maintain. Prices vary greatly from provider to provider, but all things considered, this category is significantly cheaper than traditional virtual data rooms. In addition to having purpose-built features to expedite the deal process, modern VDRs prioritize data security and ease of use. VDRs may all seem the same, but they each have distinct nuances that will make one more desirable or useful than the other, depending on a company’s preferences and needs.

As previously stated, modern VDRs concentrate on data security, which means that they incorporate sophisticated security measures, including advanced encryption both in transit and at rest, multi-level authentication procedures, and discrete data room access and revocation procedures. In addition to these system-level designs, there are document-specific security features as well, including watermarking, disabled printing, and blind view. Although security is one of the most important facets of all VDRs (both traditional and modern), modern VDRs are distinguishable from their traditional counterparts in many other ways that are rather important. Generally speaking, modern VDRs are more cost-effective, easier to implement and navigate, and have more modern user interfaces.

Dropbox

Box

Google Docs

To be clear, these solutions are not virtual data rooms. It is important to note the distinction between a deal room and another document sharing service that is typically referred to as a collaboration tool or a file sharing service. On the surface, the two may seem like similar solutions, but their differences are significant, making it difficult to include them in a true virtual data room comparison. Collaboration tools are exactly what they sound like. These tools allow users to share and collaborate on a file or document. They often have collaboration features that most VDRs lack, but are missing some of the other features that make VDRs ideal for facilitating financial transactions and safeguarding sensitive documents. Some notable examples of the players in this space are Dropbox, Box, and Google Docs. Millions of people rely on these solutions, both personally and professionally, to collaborate with others on various kinds of projects and tasks, and to share everyday files and documents.

Although these collaboration tools can be set up quickly and inexpensively, their primary limitation is their lack of security and secure file sharing measures related to document control and auditing capabilities. In many cases, these collaboration tools offer free versions, which may be able to accommodate certain needs. Of course, as a company’s needs grow and more features are desired, the cost to use the service will also begin to increase. Granted, there are certainly times when a collaboration tool may be appropriate to use. However, for companies looking to share valuable, confidential, or highly sensitive data, relying on this type of solution is a mistake. These tools aren’t set up with the same level of permission settings, auditing capabilities, watermarking, and other features that are critical when sharing confidential business information. And while excellent tools for everyday file sharing use, they lack the professional first impression that a dedicated data room has - something that a company would not want to risk when trying to sell a business or raise funds.

Chapter 6

More often than not, virtual data rooms need to be implemented quickly to facilitate an upcoming deal, so it’s common for VDR users to prioritize simplicity and ease of use over more complex, cumbersome features. Below are some additional tips to keep in mind when implementing a virtual data room.

Once a company makes the decision to invest in a VDR, it may be overwhelming deciding which solution will not break the bank and will actually provide the most value to the business. The days of complex, confusing pricing structures, hidden fees, and surprise charges are, or at least should be, long gone. A reputable, trustworthy VDR provider will clearly display its pricing scheme, data usage allowances, security standards, and other relevant features. If this information is not easy to discern on the provider website, it may be best to shift the search for a VDR elsewhere. There is plenty of competition in the space, but that does not mean that all VDRs will be a worthwhile investment.

Ultimately, companies need to consider their needs, both existing and future, to ensure that they select a VDR solution that will grow with them as they grow. Of course, in addition to the initial and monthly or annual costs, rapid adoption, immediate implementation, ease of use, and ongoing technical support will undoubtedly be top priorities. One thing that companies should consider is requesting a free trial, so that they can see whether a particular solution is the right fit.

Chapter 7

Virtual data rooms can be valuable tools for certain businesses and industries, and absolute necessities for others. VDRs vary in terms of features, complexity, and price, but finding the right solution can greatly expedite the deal process or make a major impact on your ongoing document management strategy.

Data management and security have come a long way, especially in the last five to 10 years. It is now easier than ever to invest in and set up a highly secure data storage solution, with the modern VDR being the service of choice. SecureDocs has been and continues to be a pioneer in the VDR space, and has built a strong reputation thanks to its transparent pricing, practical features that actually get used, an intuitive, user-friendly interface, and industry-leading 24/7 customer support.

A SecureDocs Virtual Data Room offers a quick setup, is easy to use, and has industry-leading security- all at a price that is well below the rates of traditional data room providers.

Features Include:

6500 Hollister Ave.

Suite 110

Goleta, CA 93117

United States Sales:

866 700 7975 ext. 1

International Sales:

001 805 259 1269 ext. 1

© 2024 All rights reserved.