The Official SecureDocs Blog

Stay on top of the latest tips, trends, and best practices for M&A, fundraising, and other business events.

Browse by topic

Subscribe to our blog

-

M&A

Q3 M&A Recap: Global Activity Sluggish, US Leads

-

Venture Capital

Private Equity 2023 Mid-Year Recap: A Tough First Half

-

Virtual Data Room

Revolutionizing Board Communications with Virtual Data Rooms

-

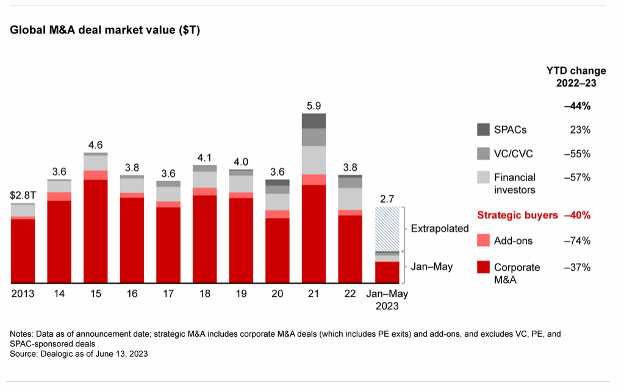

M&A

Q2 2023 Yields Cautious Optimism for M&A

-

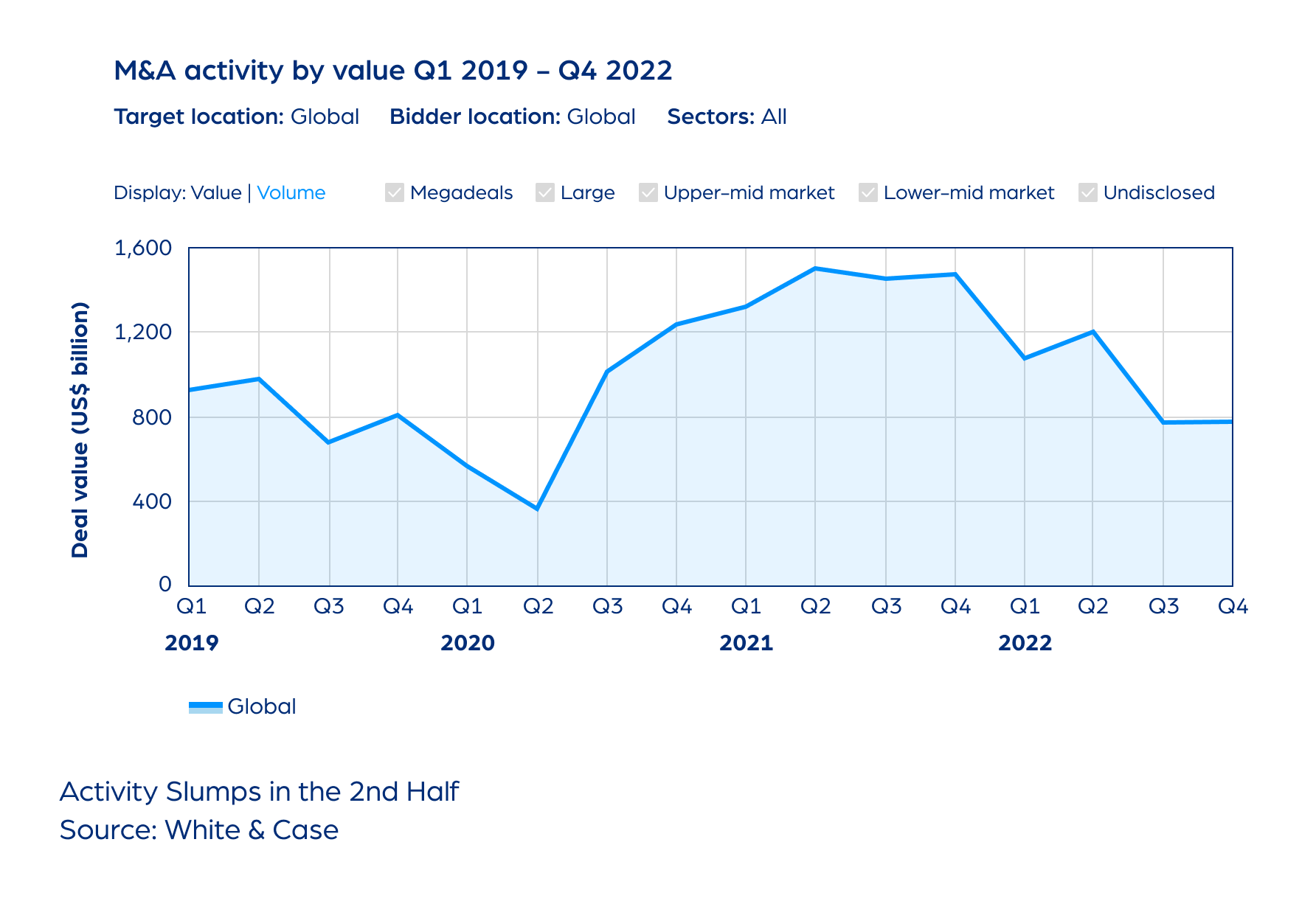

M&A

Q1 M&A: Running Against the Wind

-

M&A

Q1 Life Sciences: Resilient in a Changing Landscape

-

IPO

IPOs plummet in 2022. What Comes Next?

-

M&A

2022: Tough Environment, Resilient Market

-

M&A

Earnouts: Seeking Safety in a Transaction

-

Fundraising

5 Common Fundraising Questions Answered

-

Startups

Corporate Repository: Rethinking the Way You Do Business

-

Audits

Simplify Your Audit With a Virtual Data Room

current_page_num+2: 3 -