The Official SecureDocs Blog

Stay on top of the latest tips, trends, and best practices for M&A, fundraising, and other business events.

Browse by topic

Subscribe to our blog

-

Private Equity

Private Equity: What Is a Capital Call?

-

Company Updates

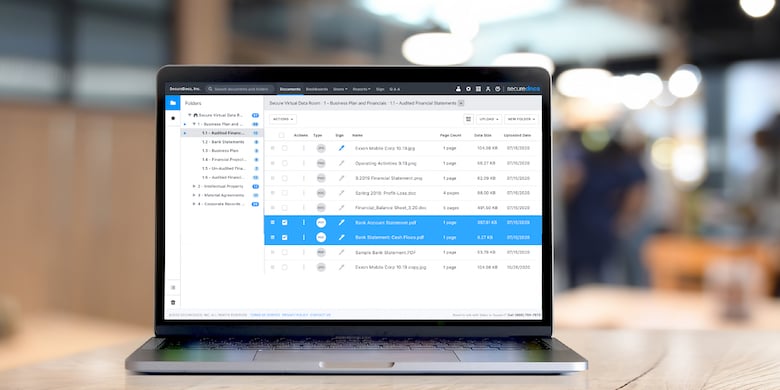

Working in SecureDocs is Now Easier than Ever

-

Risk & Compliance

Q3 2020 M&A Recap: What Did We Learn and What's Ahead?

-

.jpg)

Risk & Compliance

Is a Joint Venture Right for Your Business?

-

.jpg)

Risk & Compliance

6 Reasons to Consider a Divestiture

-

.jpg)

Virtual Data Room

What is a Data Room?

-

.jpg)

Risk & Compliance

Common Fees to Expect During M&A Deals

-

.jpg)

Risk & Compliance

6 Tips for Setting Up a Virtual Data Room

-

.jpg)

Intellectual Property

5 Best Practices for Protecting Your Intellectual Property

-

.jpg)

Risk & Compliance

5 Top Buyer Concerns During the M&A Due Diligence Process

-

.jpg)

Risk & Compliance

6 Tips When Preparing to Sell Your Business

-

.jpg)

Risk & Compliance

4 Ways to Speed Up M&A Due Diligence

current_page_num+2: 7 -